Understand market and portfolio states — without prediction.

Tectoniq is a descriptive market risk analysis platform.

It helps you understand what is happening, not what will happen.

No signals. No advice. No hidden incentives.

Tectoniq's approach: describe states, not outcomes.

- •Markets move through regimes

- •Assets behave differently depending on regime

- •Diversification can fail when assets share the same state

- •Understanding structure reduces false confidence

Tectoniq describes these states using transparent, reproducible metrics.

What Tectoniq shows you

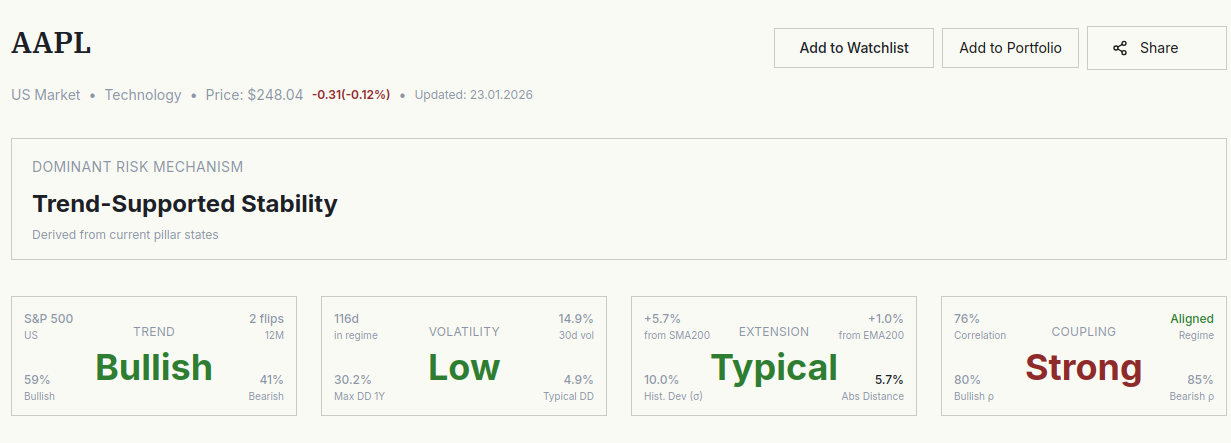

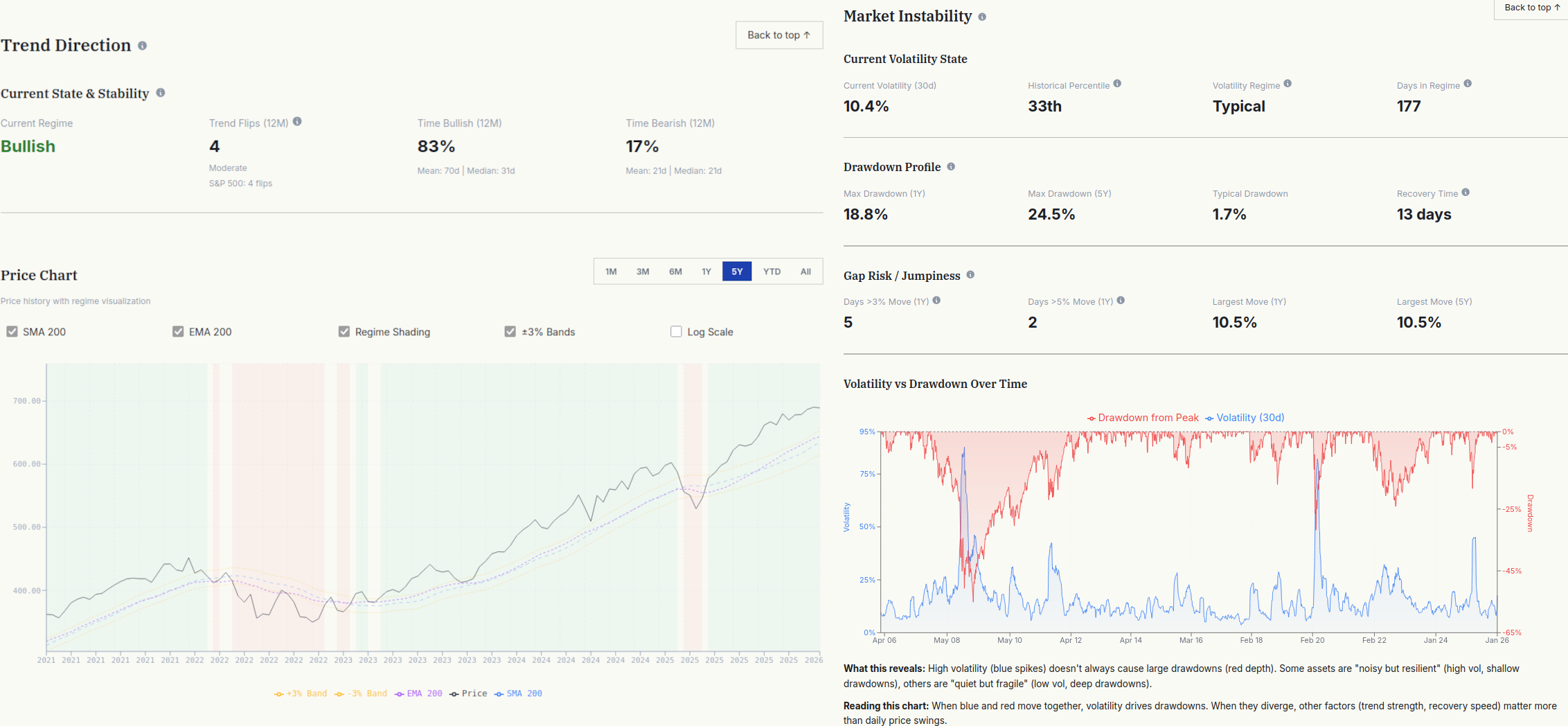

Single Asset

Is this asset extended, volatile, or tightly coupled to the market — relative to its own history?

Watchlists

Which assets are structurally unusual — and why.

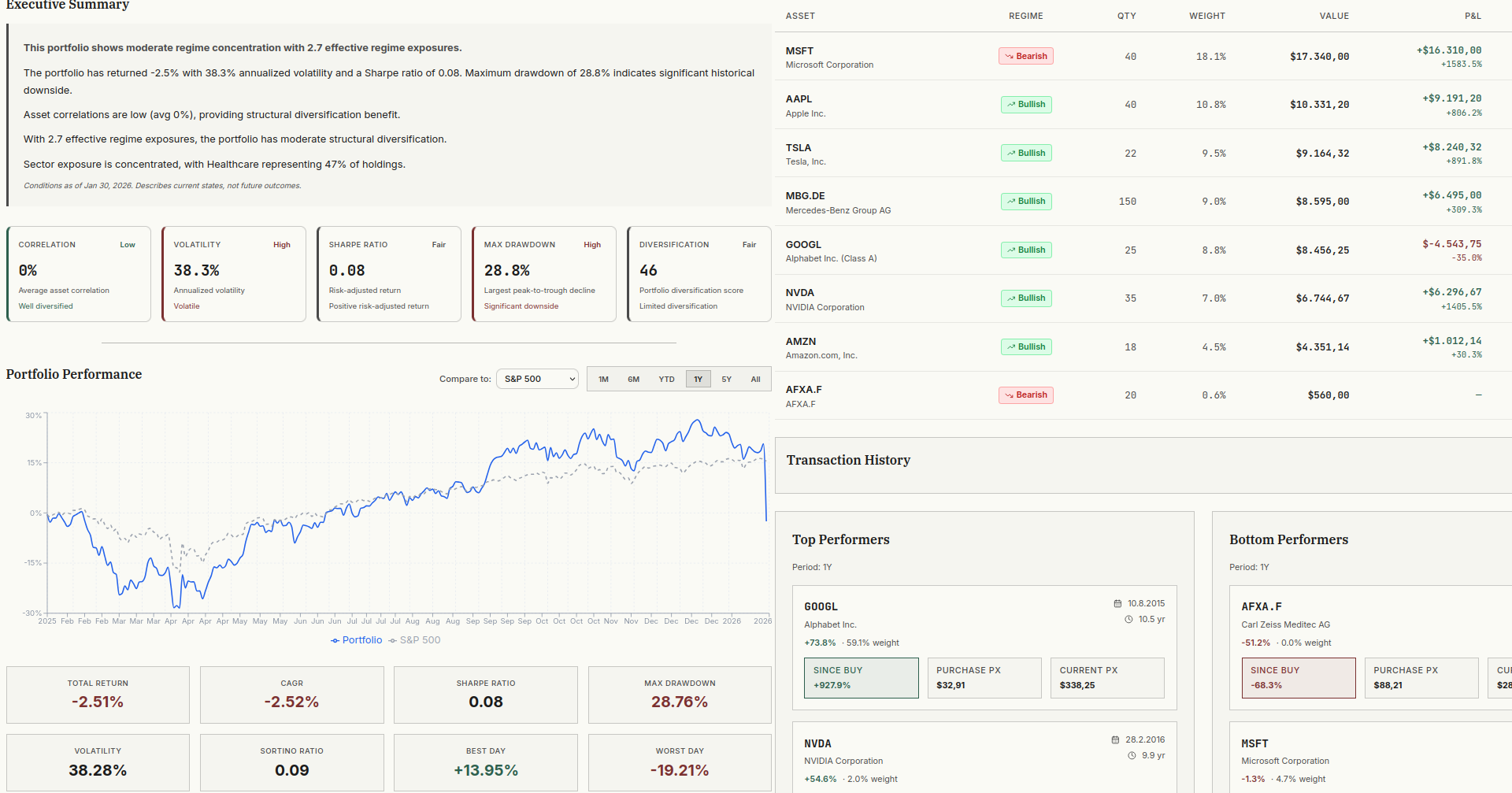

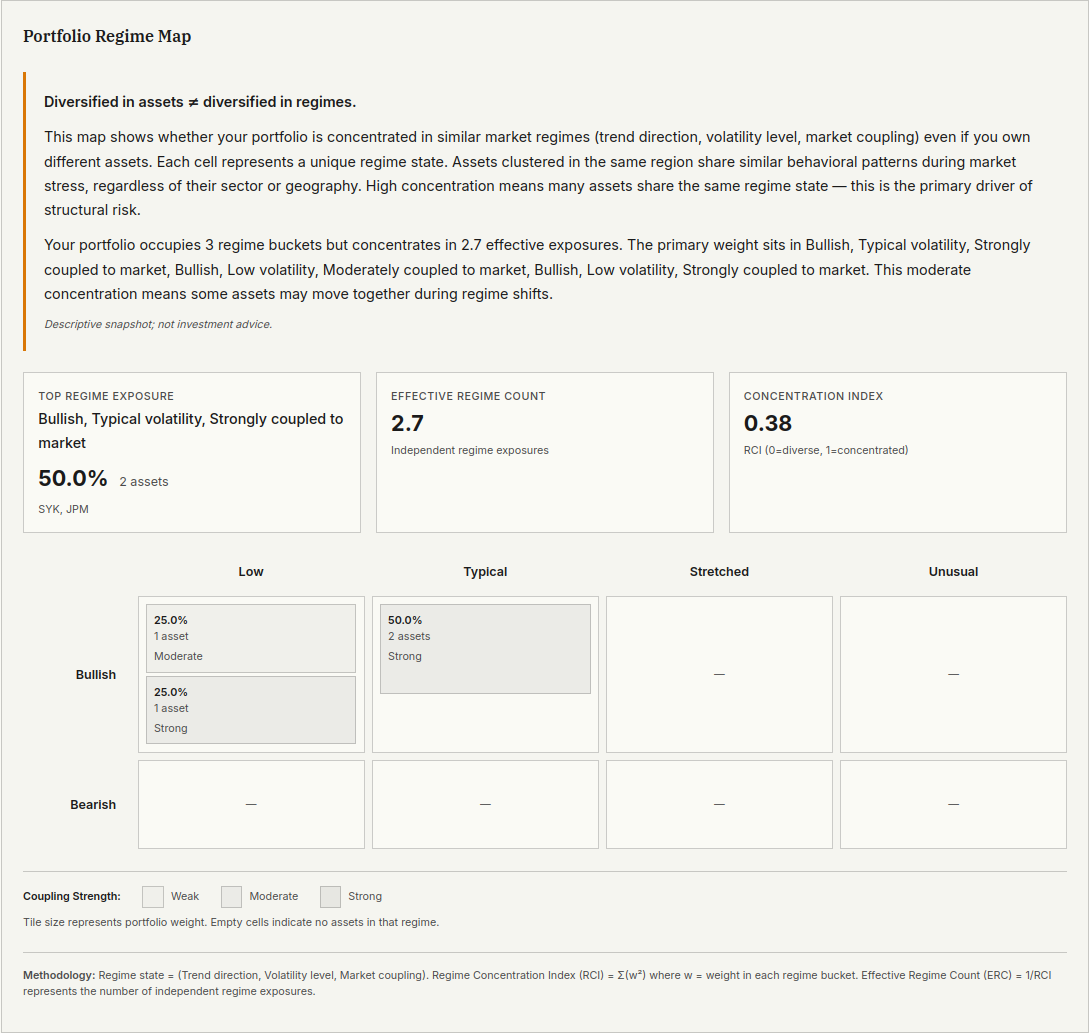

Portfolio

Is your portfolio diversified by assets, or concentrated by regime?

Diversified in assets ≠ diversified in regimes

A portfolio can hold many assets and still fail together if those assets share the same market regime.

This is a diagnosis, not a recommendation.

Access

•Explore without an account

•Register for ongoing single-asset context

•Subscribe for portfolio-level diagnostics

Transparent by design

Methodology is visible, limitations are explicit, and uncertainty is acknowledged.

IMAGE PLACEHOLDER

Understand market structure before acting on conviction.